Unmatched Credits

This report enables you to view the unmatched credits for a merchant over a specified date range. It generates this data based upon smart-rule logic. The rule compares a refund transaction against sale transactions to determine if a matching sale transaction occurred prior to it within four different date ranges (up to 7 days, between 7 and 30 days, between 30 and 60 days, and between 60 and 90 days).

To view batch and transaction details:

- In the Batch Date column, select the link for the batch date you want to view.

The Batch Detail - Unmatched Credits page opens.

- To view the details for a transaction, select the transaction sequence link in the Transaction Sequence column.

The Transaction Detail screen opens.

You can  filter the report based on specific values in any of these fields:

filter the report based on specific values in any of these fields:

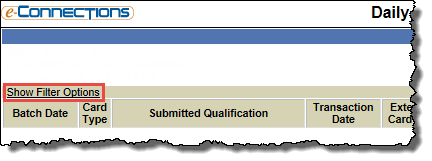

If a report has a Show Filter Options link, it means you can filter the report based on specific field values.

To filter a report:

- Select Show Filter Options.

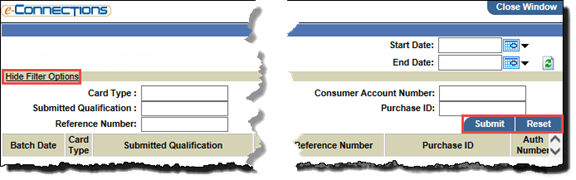

The page refreshes to show the filter options fields and buttons; for example:

- Enter information in any of the filter options fields to report on those specific criteria.

- Select Submit.

The report refreshes to show the filtered results.

- Select Reset to return to the original, unfiltered list.

Tip: To hide the filter options, select Hide Filter Options.

Consumer Account Number

Consumer Account NumberThe consumer account number for the transaction. This can be a credit card number for a card transaction or a DDA number for an ACH transaction.

Payment Type

Payment TypeThe payment type associated with the transaction; possible values:

- All

- Visa

- MasterCard

- American Express

- Discover

- PayPal

- Diners Club

- EBT

- Electronic Check Conversion

- JCB

- Online Debt Card

- POS Check

- ACH as a Tran

- Others

- Purchase ID

- Date/Time

Auth Number

Auth NumberThe authorization code for the transaction.

Amount

AmountThe dollar value associated with a transaction or set of transactions.

filter the report based on specific values in any of these fields:

filter the report based on specific values in any of these fields: Consumer Account Number

Consumer Account Number Payment Type

Payment Type Auth Number

Auth Number Amount

Amount