Negative Reserves/Send Debit

A merchant's  Send Debit setting determines whether or not the merchant can be debited:

Send Debit setting determines whether or not the merchant can be debited:

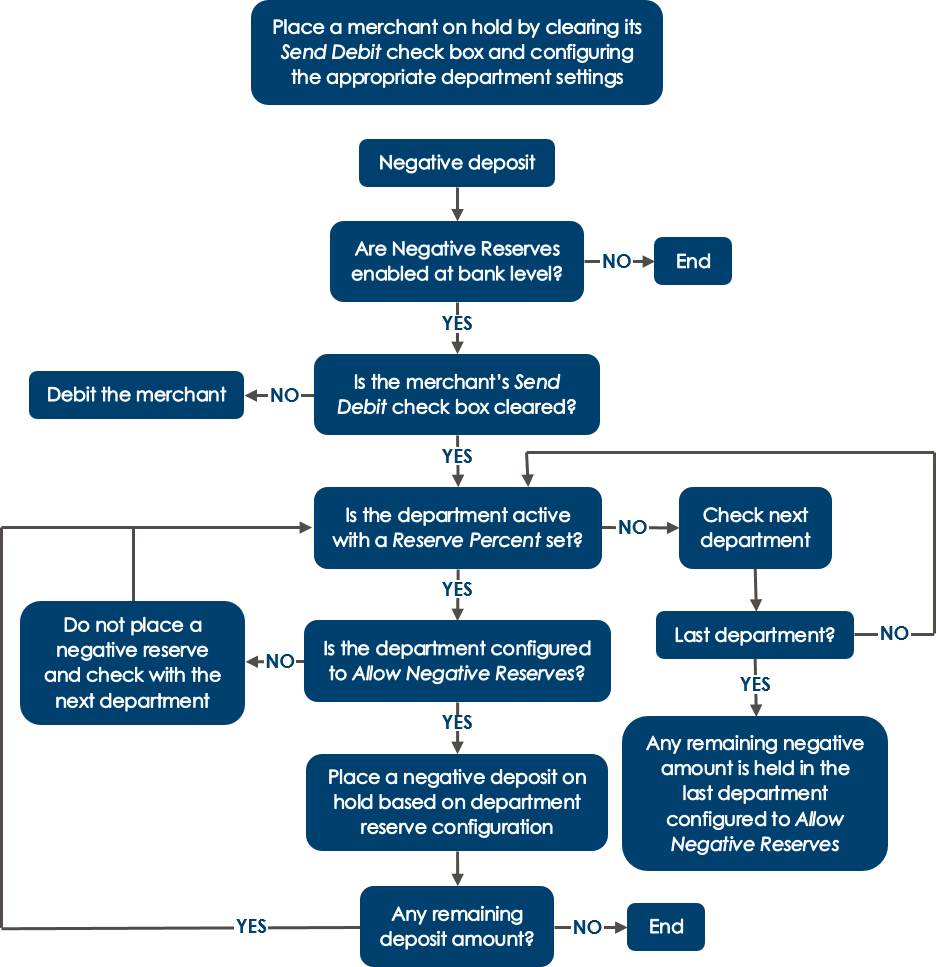

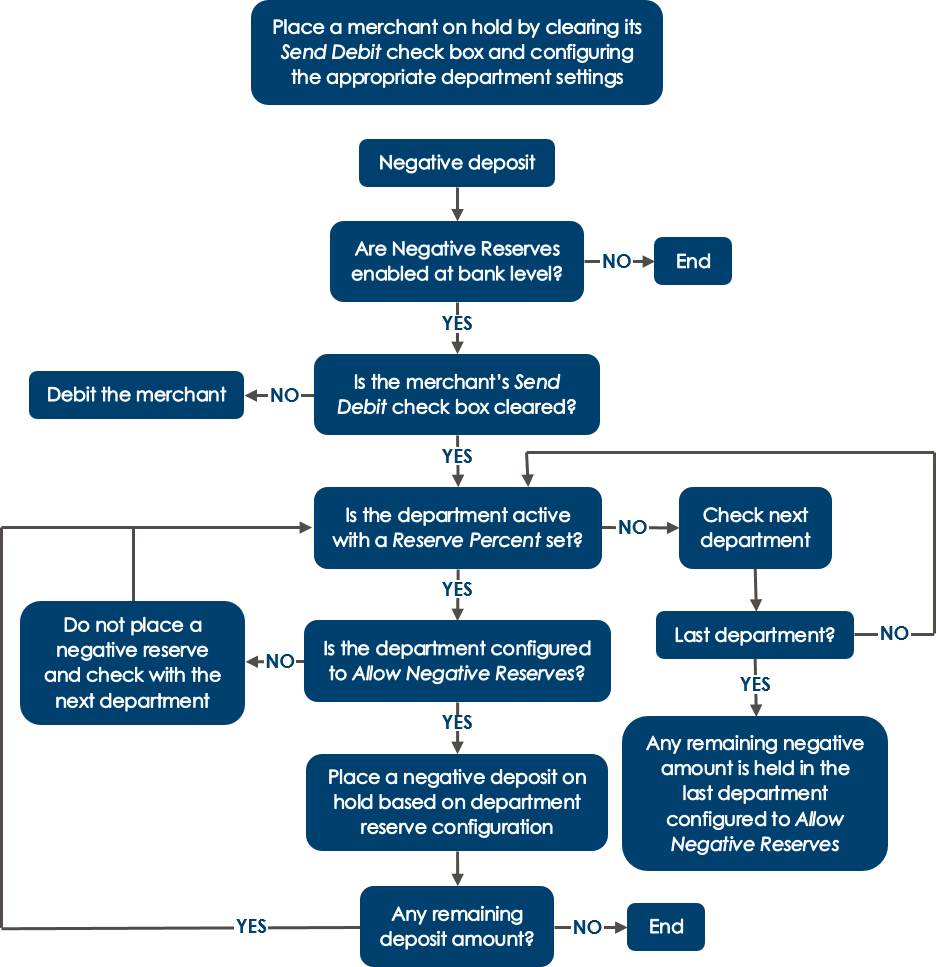

- If the merchant's Send Debit check box is selected, the debits are processed for the merchant and not reserved.

- If the merchant's Send Debit check box is cleared, the debits are reserved in the department that has an active reserve setting and allows negative reserves.

All negative reserves are treated as net, regardless of the  ACH Indicator setting in the Manage Merchant Reserve box for the merchant.

ACH Indicator setting in the Manage Merchant Reserve box for the merchant.

This value indicates how the reserve entries will be handled in the ACH file for the Merchant DDA. This is set as a Bank Default, but the value can be changed when adding or updating a Reserve ID or as a merchant-level Reserve Setting.

Select one of the following values from the drop-down list:

- Net: Indicates the Reserve Funding amount is subtracted from the merchant's Net Deposit, so the merchant will see one credit entry with the Net amount against their DDA.

- Separate: Indicates separate entries for the Reserve Funding are created for ACH processing, so the merchant will see two entries against their DDA: one credit entry for the Net Deposit, and one debit entry for the Reserve Funding amount.

When a merchant has a negative deposit amount, the system evaluates the merchant's Send Debit check box setting. If the merchant's Send Debit check box is cleared, the negative deposit amount is reserved in the first department (according to the  Department Priority setting) that is configured to allow negative reserves. If there is any negative deposit amount remaining, the system attempts to reserve it in the next department (according to the Department Priority setting) that is configured to allow negative reserves, and so on until the total negative deposit amount is processed or there are no remaining departments that can reserve the remaining negative deposit amount.

Department Priority setting) that is configured to allow negative reserves. If there is any negative deposit amount remaining, the system attempts to reserve it in the next department (according to the Department Priority setting) that is configured to allow negative reserves, and so on until the total negative deposit amount is processed or there are no remaining departments that can reserve the remaining negative deposit amount.

A priority number to determine the order in which the department will collect reserve funds relative to other departments.

For example, a department with a priority of 1 will collect the designated amount first before any other departments collect. A priority 2 department will collect the designated amount from the remaining balance after the priority 1 department has collected. A priority 3 department will then collect the designated amount from the remaining balance after the departments of priority 1 and 2 have collected, and so on.

Changing the priority of one department will reorder the other department priority numbers accordingly.

Note: If the ACH Deposit Cap is selected when setting a reserve, the ACH Deposit Cap field can only be populated for a department set with a priority of 1.

Note: If a department has a positive reserve balance, the negative amount held will reduce that reserve balance.

To place a full hold on a merchant, clear the merchant's Send Debit check box, and in one of the merchant's reserve funding departments, set the Reserve Percent to 100. All debits and credits for that merchant are then held, including deposits, credits (returns), chargebacks, chargeback reversals, adjustments, and daily fee.

Note that, in the Manage Merchant Reserve box for a merchant:

- Only a value in the Reserve Percent field can effectively be used to hold an incoming negative deposit amount.

- The Reserve Amount field cannot contain a negative value, and any value in this field will not be applied against an incoming negative deposit amount.

This chart outlines the negative deposit workflow after placing a merchant on hold:

Send Debit setting determines whether or not the merchant can be debited:

Send Debit setting determines whether or not the merchant can be debited: ACH Indicator setting in the Manage Merchant Reserve box for the merchant.

ACH Indicator setting in the Manage Merchant Reserve box for the merchant. Department Priority setting) that is configured to allow negative reserves. If there is any negative deposit amount remaining, the system attempts to reserve it in the next department (according to the Department Priority setting) that is configured to allow negative reserves, and so on until the total negative deposit amount is processed or there are no remaining departments that can reserve the remaining negative deposit amount.

Department Priority setting) that is configured to allow negative reserves. If there is any negative deposit amount remaining, the system attempts to reserve it in the next department (according to the Department Priority setting) that is configured to allow negative reserves, and so on until the total negative deposit amount is processed or there are no remaining departments that can reserve the remaining negative deposit amount.