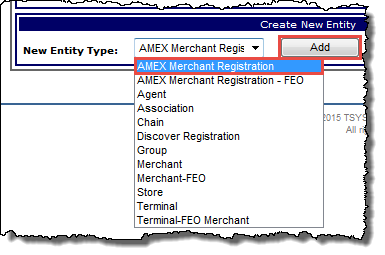

To register a full service merchant for AMEX:

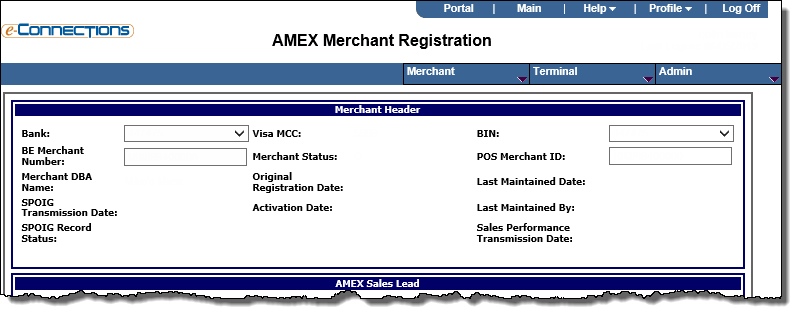

The  Amex Merchant Registration page opens where you can register the merchant.

Amex Merchant Registration page opens where you can register the merchant.

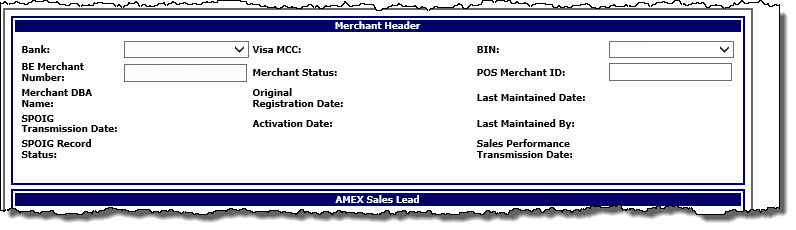

The fields in this panel allow you to enter basic merchant registration information. Your selection from the Bank drop-down list may auto-populate some of the other fields in this panel if the merchant already exists in Express, and some fields are not populated until after the merchant registration is boarded. For example, the Original Registration Date, Last Maintained Date, and Last Maintained By fields are read-only fields that populate after registration.

Bank

BankFrom the drop-down list, select the bank number for the merchant.

BIN

BINFrom the drop-down list, select the six-digit number that identifies the client bank. A BIN is assigned by TSYS Acquiring Solutions and is the highest level of the front-end hierarchy. The front-end hierarchy is used by TSYS Acquiring Solutions to route an authorization or batch to the correct Acquirer. BINS contain Agents, the second level of the front-end hierarchy.

BE Merchant Number

BE Merchant NumberThe 9-16 digit back end merchant identification number.

POS Merchant ID

POS Merchant IDThe unique, 12-digit number that identifies the merchant to the client or agent bank.

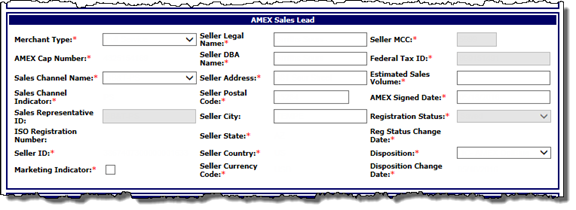

The fields in this panel provide details about the sales channel, the merchant, the sales disposition, and other registration details used for the AMEX Sales Performance and Sponsored Merchant files sent to American Express. Some fields are mandatory, depending on whether the merchant is signing up for the American Express OptBlue program, the American Express ESA program, or if they choose not to accept American Express.

American Express requires sales lead information about merchants who have declined to participate in the OptBlue program. Merchants not participating in the OptBlue program either chose not to accept American Express at all or have signed up directly with American Express through their American Express External Sales Agent (ESA) program.

Merchant Type

Merchant TypeFrom the drop-down list, select one of these options to indicate whether the merchant processes on the TSYS back-end or is a full service merchant (processing on both the front end and back end systems):

AMEX Cap Number

AMEX Cap NumberAn American Express identification number assigned to each PSE per transmit bank to distinguish who gets paid. A PSE client/bank will have one CAP number for each transmit bank. This field is automatically populated based on the Bank number.

Sales Channel Name

Sales Channel NameThe name of the direct or indirect TSYS client that is registering the merchant for the American Express OptBlue program. Typically, there is only one default option available here, and it is the name of the sales channel set up for the AMEX CAP Number.

Sales Channel Indicator

Sales Channel IndicatorThe type of sales channel selected in the Sales Channel Name field. This field is auto-populated and read only. Possible values are:

Sales Representative ID

Sales Representative IDThe identification information for the sales representative registering the merchant. If the Sales Channel Indicator is set to PSP Channel, then this field will default to the name of the PSP.

ISO Registration Number

ISO Registration NumberThis number identifies the individual ISOs under an acquirer (Participant Sales Entity - PSE) and is assigned by TSYS during the ISO registration process. The number is linked to a specific Participant CAP number. ISOs will register their merchants under their ISO Registration number. If the sales channel is an ISO, wholesale ISO, or retail ISO, then this field will automatically populate.

Seller ID

Seller IDThis number identifies a single merchant. A merchant may operate under multiple MCCs so they may be assigned multiple Industry SE numbers under their Seller ID.

Marketing Indicator

Marketing IndicatorWhen this check box is selected, it enables American Express direct mail, newsletters, or messages about products, services and resources to be sent to the merchant. Communications may also be sent via inbound telephone, email, fax, website and any other means identified by sales channel. If the merchant does not enable this option, they may still receive messages from American Express regarding services and programs designed to enhance the value of the American Express Network.

Seller Legal Name

Seller Legal NameThe legal business name of the merchant.

Seller DBA Name

Seller DBA NameThe merchant's DBA (Doing Business As) name.

Seller Address

Seller AddressThe physical address of the merchant location. This cannot be a PO Box number.

Seller Postal Code

Seller Postal CodeThe ZIP code associated with the merchant’s physical address. This postal code must be within the 50 US states and Washington DC.

Seller City

Seller CityThe city associated with the merchant’s physical address. This field will automatically default based on the postal code; however, you can also manually change the city.

Seller State

Seller StateThe state associated with the merchant’s physical address. This field will automatically default based on the Seller Postal Code.

Seller Country

Seller CountryThe country associated with the merchant’s physical address. This field will automatically default based on the Seller Postal Code. The only valid value for this field is the United States.

Seller Currency Code

Seller Currency CodeThe currency type accepted by the merchant. This field is automatically populated based on the Seller Postal Code.

Seller MCC

Seller MCCThe four-digit Merchant Category Code (MCC) for the merchant.

Federal Tax ID

Federal Tax IDThe merchant’s Federal Tax ID assigned by the IRS.

Estimated Sales Volume

Estimated Sales VolumeThe estimated annual American Express sales volume for the merchant.

AMEX Signed Date

AMEX Signed DateThe date the merchant signed up for American Express.

Registration Status

Registration StatusThe current status of the American Express registration. Possible values are:

Reg Status Change Date

Reg Status Change DateThe date the registration status changed on the American Express merchant registration.

Disposition

DispositionFrom the drop-down list, select one of these options to indicate the disposition status of the merchant with American Express:

Note: Once a merchant has been boarded with a disposition status of 1C- AMEX OptBlue or 3E- OptBlue-New Provide, its disposition status can only be changed to either of those options.

Merchant registration records with this disposition status will be considered as registered for OptBlue, along with those having a disposition status of 1C- AMEX OptBlue, and will be reported to American Express as an OptBlue Seller. Using the disposition status of 3E- OptBlue-New Provider will help to distinguish merchants who have previously accepted American Express from those who are new to American Express card acceptance. The disposition status of 1C- AMEX OptBlue should be used to register merchants who are accepting American Express for the first time, if known, at the time of registration.

Note: Once a merchant has been boarded with a disposition status of 1C- AMEX OptBlue or 3E- OptBlue-New Provide, its disposition status can only be changed to either of those options.

This disposition status can provide flexibility when boarding merchants. Merchant registration records with this disposition status will not be considered as an OptBlue opportunity and will not be reported to American Express.

This disposition status is intended for your internal reporting and tracking purposes only, along with the disposition status of 1B- AMEX ESA.

Disposition Change Date

Disposition Change DateThe date the merchant disposition was changed.

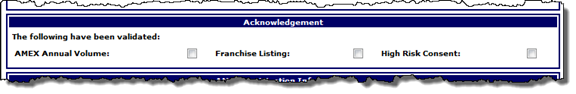

The page refreshes to include this panel if you select AMEX Non-Acceptor Signed OptBlueSM from the Disposition drop-down list in the AMEX Sales Lead panel.

AMEX Annual Volume

AMEX Annual VolumeWhen selected, this check box indicates that the sales channel has verified the merchant’s annual American Express sales volume. The annual American Express sales volume cannot exceed one million USD to participate in the American Express OptBlue program.

Franchise Listing

Franchise ListingWhen selected, this check box indicates that the sales channel has verified that the merchant is not on the American Express Franchise Exclusion List.

High Risk Consent

High Risk ConsentWhen selected, this check box indicates that the sales channel has completed all high risk merchant verification requirements. If the merchant falls into one of the High Risk Merchant Categories, the sales channel must follow all high risk verification requirements.

The page refreshes to include this panel if you select AMEX Non-Acceptor Signed OptBlueSM from the Disposition drop-down list in the AMEX Sales Lead panel.

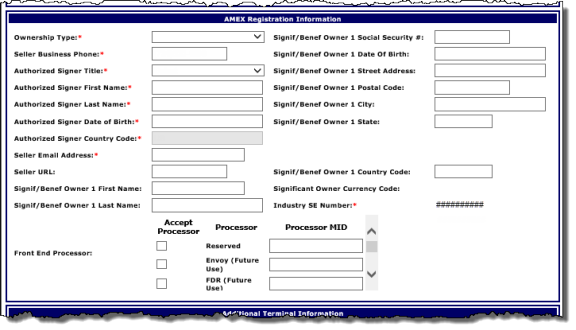

Ownership Type

Ownership TypeThe ownership type for the merchant's business.

Seller Business Phone

Seller Business PhoneThe merchant’s business phone number.

Authorized Signer XXX

Authorized Signer XXXVarious required fields for the authorized signer's information; Authorized Signer Title, Authorized Signer First Name, etc.

Seller Email Address

Seller Email AddressThe merchant’s business email address. This field is required for MCC 5969. Use standard email format (for example, email@server.com).

Seller URL

Seller URLThe merchant’s business website URL. This field is required for MCC 5969. Use standard URL format (for example, http:/companyname.com or companyname.com).

Signif/Benef Owner XXX

Signif/Benef Owner XXXThese significant or beneficiary owner fields (Signif/Benef Owner 1 First Name, Signif/Benef Owner 1 Last Name, etc.) are required.

Industry SE Number

Industry SE NumberAn identification number required for authorization, settlement, and reporting. A single Participant CAP number is assigned 10 unique Industry SE numbers. Every Industry SE number correlates with a Merchant Category Code (MCC) to represent the business type. Merchants with the same MCC are assigned to the same Industry SE number.

Front End Processor

Front End ProcessorThese fields identify the front-end processors for the merchant. Entry is only required if the merchant only processes back-end transactions on the TSYS platform. For each appropriate processor, select the Accept Processor check box and enter its relevant Processor MID.

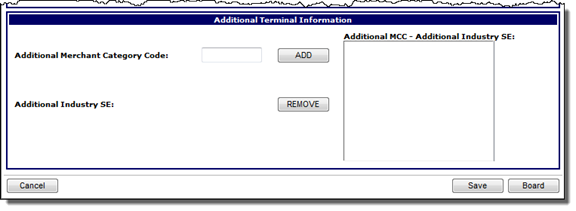

Additional Terminal Information

Additional Terminal Information

The page refreshes to include this panel if you select AMEX Non-Acceptor Signed OptBlueSM from the Disposition drop-down list in the AMEX Sales Lead panel. This panel allows you to identify additional MCCs set up for the terminals. This information is required in order to board terminals under a different MCC than identified in the Merchant Header panel.

To add an MCC:

The MCC appears in the Additional MCC - Additional Industry SE list. The Additional Industry SE number for the MCC will automatically populate based on the bank setup.

The MCC is deleted from the Additional MCC - Additional Industry SE list.

Saving the merchant allows you to store the registration if you need to board it at a later date. Once you are ready to board the request, you can search for the merchant from the AMEX Merchant Registration Homepage, edit the required information, and then board the request. Boarding the merchant will register the merchant for American Express in the TSYS system and send the merchant information to American Express.

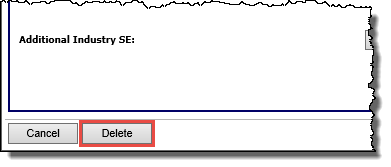

Note: If the merchant's AMEX Merchant Registration record has been saved but has not yet been registered, a Delete button appears at the bottom of this page, which you can click to delete the record. This enables you to remove any saved merchant registration record that is no longer valid or no longer needed. Once a merchant’s registration record has been boarded, this button and the delete functionality will no longer be available for the record.

Tip: You can view a list of saved records by searching for merchants whose Registration Status is Saved.

-or-

If you opened this page from the Homepage, and have completed the fields on this page and validated all required information per the American Express OptBlue Operating Regulations, board the merchant by clicking Board.

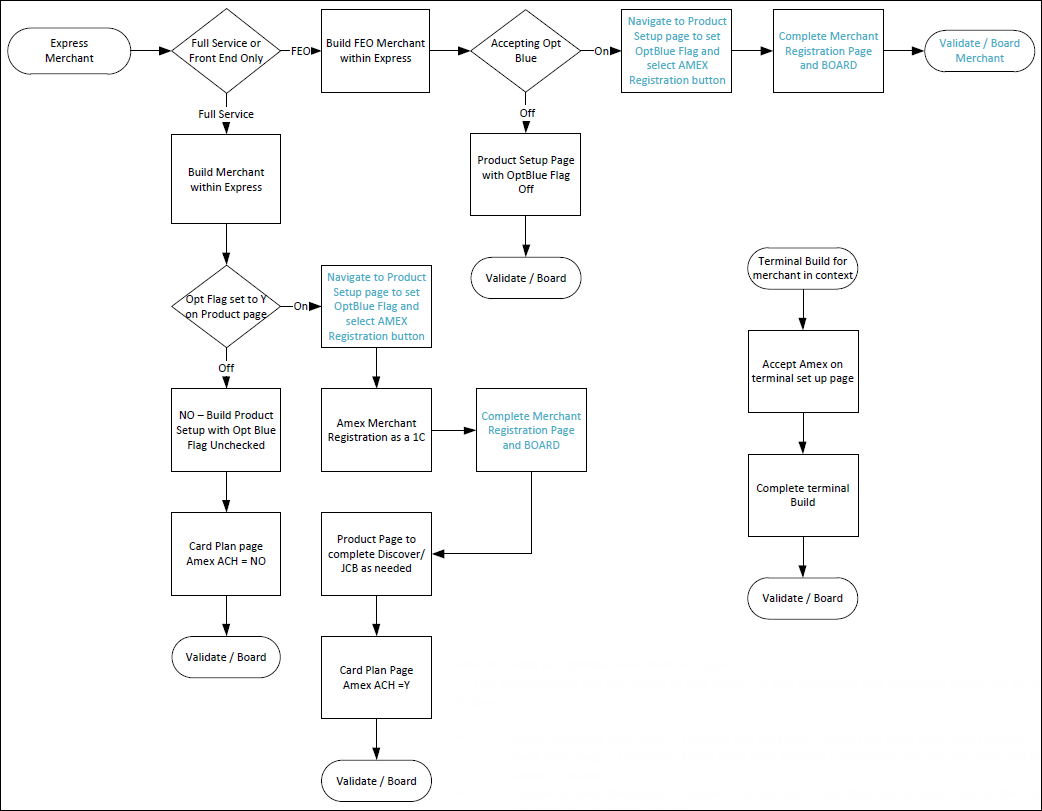

Here is the process flow for American Express full service merchant registration: