Deposit Detail

Select this link to run the Association Deposit Detail report.

This report includes these features:

- Total non-Settled Activities Impacting Deposit: The sum of Posted Non-Settled Sales & Returns, Posted Non-Settled Chargebacks, Posted Non-Settled Adjustments, Posted Non-Settled Fees, and Posted Non-Settled Reserves.

- Posted Non-Settled Sales & Returns: The sum of all Non-Settled Sales & Returns not included in the Deposit.

- Posted Non-Settled Chargebacks: The sum of all Non-Settled Chargebacks not included in the Deposit.

- Posted Non-Settled Adjustments: The sum of all Non-Settled Adjustments not included in the Deposit.

- Posted Non-Settled Fees: The sum of all Non-Settled Fees not included in the Deposit.

- Posted Non-Settled Reserves: The sum of all Non-Settled Reserves not included in the Deposit. A link on the Non-Settled Reserves Amount opens a new Non Settled-Reserve report with the Merchant or Association in context. Reserves will be summed and itemized by Deposit Date and will include: Deposit Date, Batch Date, ACH Tran Destination, TSYS Tran Code, Qual Code, Debit Credit indicator, DDA Number, Transit Routing Number, Reference Number, Reject Indicator, and Deposit Amount.

You can  filter the report based on specific values in any of these fields:

filter the report based on specific values in any of these fields:

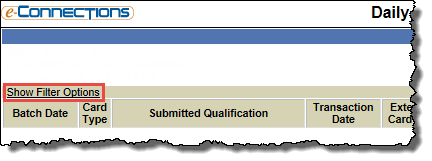

If a report has a Show Filter Options link, it means you can filter the report based on specific field values.

To filter a report:

- Select Show Filter Options.

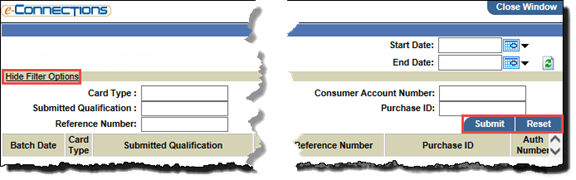

The page refreshes to show the filter options fields and buttons; for example:

- Enter information in any of the filter options fields to report on those specific criteria.

- Select Submit.

The report refreshes to show the filtered results.

- Select Reset to return to the original, unfiltered list.

Tip: To hide the filter options, select Hide Filter Options.

- Deposit Date

ACH Table

ACH TableThe four-character ACH table number. This number is the same as the client ACH file header.

Reference Number

Reference NumberThe payment type associated with the transaction; possible values:

- All

- Visa

- MasterCard

- American Express

- Discover

- PayPal

- Diners Club

- EBT

- Electronic Check Conversion

- JCB

- Online Debt Card

- POS Check

- ACH as a Tran

- Others

- Deposit Amount

ACH Tran Destination

ACH Tran DestinationThe Payment Hierarchy Level at which the merchant is paid. This can be one of the following:

DDA Number

DDA NumberThe merchant's 10-character Demand Deposit Account number. This is a checking account used for transferring funds to and from a merchant for credit card processing deposits and fees.

For example, enter a Deposit Amount and select the > operator from the adjacent drop-down list to view transactions for deposit amounts greater than that amount.

Follow these steps to view more detailed information:

- To view batch details, in the Batch Date column, select a date link.

The Merchant Settlement Details report opens.

- To view reject details, scroll right and, in the Rejects column, select the Y link.

The Merchant Rejects report opens.

- To view the sum of all Non-Settled Reserves not included in the Deposit, select amount link for the Posted Non-Settled Reserves (in the Amount column).

The Non Settled-Reserves report for the merchant opens. Reserves are summed and itemized by Deposit Date.

- Depending on your system setup and user permissions, and providing the merchant in context is set up in the TSYS Portfolio Pricing ManagerSM (PPM) application, you can select the Merchant DDA History link to open the Merchant DDA Setup History page.

filter the report based on specific values in any of these fields:

filter the report based on specific values in any of these fields: ACH Table

ACH Table Reference Number

Reference Number ACH Tran Destination

ACH Tran Destination DDA Number

DDA Number