Bank Exception Tables

The bank exception tables monitor daily activity after transactions have been cleared and settled. They provide clients and Global Payments users with the flexibility to use various parameters to monitor merchant activity.

Bank exceptions tables make it possible for a bank to identify when a merchant is experiencing unusual transaction volumes, or abnormal levels of particular transaction types. Unusual activity can be an indicator of fraud or a system malfunction. Regardless of the cause of the unusual activity, it is the bank exception tables that help a bank identify merchant activity that may need further investigation.

You configure bank exception tables by adding one or more categories from the list of available exception categories. You then add comparisons to the table by selecting them from the list of existing comparisons. Finally, you select a category-comparison combination and add the specific criteria that will be used to determine an exception.

Note: Bank exception table "0000" is reserved by the system. It cannot be added, modified, copied, or deleted.

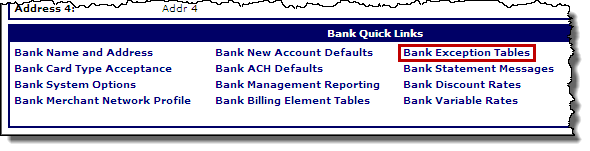

Navigation

- Open the

Bank Summary page for the bank.

Bank Summary page for the bank.The Bank Summary page provides basic status, demographic, and contact information for a selected bank. From this page, you can browse to the other bank maintenance pages with the selected bank in context. This allows you to view detail information and make changes to the bank record.

To view the Bank Summary page for a bank:

- In the Bank Quick Links panel, click Bank Exception Tables.

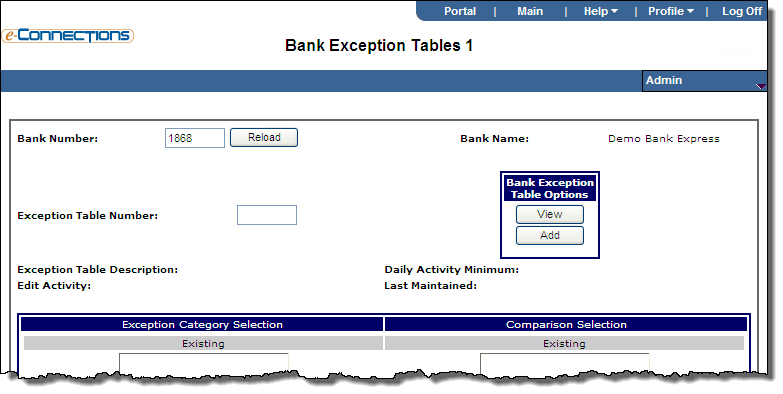

The Bank Exception Tables 1 page opens.

Add bank exception tables

You can add a bank exception table by entering original information, or you can copy an existing exception table.

- Type the number of the new table in the Exception Table Number field.

- Click Create New Exception to create a new table.

- To copy information from an existing exception table:

- Enter the existing table number in the Copy Exception Table From field.

- Click Copy.

- Enter values for required fields and optional fields, as needed.

- Select the categories that you want to monitor from the Available list in the Exception Category Selection table.

- Click Add.

The selected category moves from the Available list to the Existing list.

- Select a category from the Existing list.

- Select the comparisons that you want to make from the Available list in the Comparison Selection table.

- Click Add.

- Select a comparison from the Existing list in the Comparison Selection table.

- Click Comparison Detail.

The Bank Exception Table Details page displays.

- Enter values for required fields and optional fields, as needed.

- To return to the Bank Exception tables page and configure another category-comparison combination, click Continue.

- To process the bank exception table, click Validate.

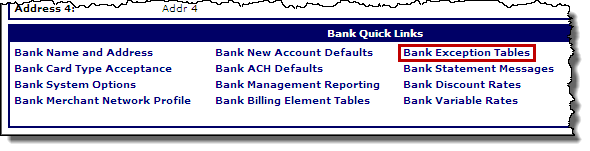

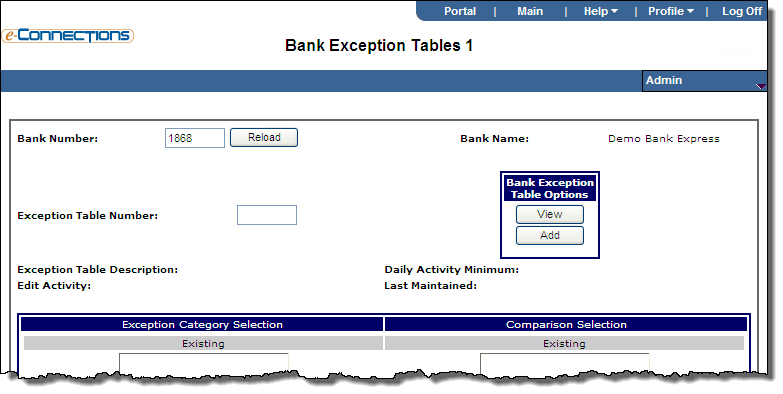

Modify bank exception tables

- Type the exception table number for the table that you want to modify in the Exception Table Number field.

- Click View.

- Click Edit.

- Enter values for required fields and optional fields, as needed.

- To remove categories and comparisons from the exception table:

- Highlight the item that you want to remove.

- Select Remove Category or Remove Comparison, as appropriate.

- To modify a category-comparison combination:

- Select the category and comparison that you want to modify from the Existing lists.

- Click Comparison Detail.

- Enter values for required fields and optional fields, as needed.

- To return to the Bank Exception tables page or to modify another category-comparison combination, click Next.

- Click Validate.

Delete bank exception tables

Bank exception tables that have a merchant or an association pointing to it cannot be deleted.

- Type the exception table number for the table that you want to delete in the Exception Table Number field.

- Click View.

- Click Edit.

- Click Delete.

Bank Summary page for the bank.

Bank Summary page for the bank.