The Consumer ACH Outgoing Transactions report will only contain data if you participate in Consumer ACH. The report can help with your daily reconciliation efforts for Consumer ACH totals.

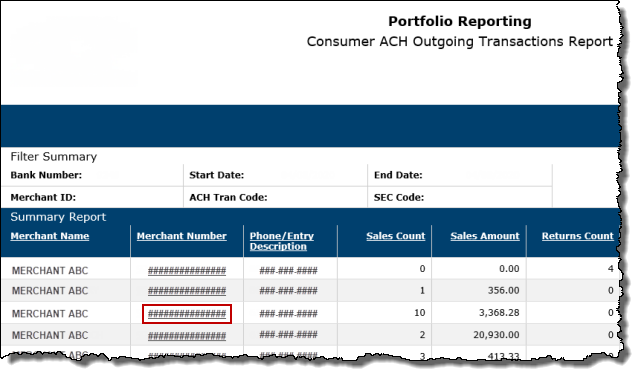

When you run the report, it first opens as a  Summary Report. You can then select a Merchant Number to drill down to the Detail Report, listing the individual transactions for that merchant.

Summary Report. You can then select a Merchant Number to drill down to the Detail Report, listing the individual transactions for that merchant.

ACH.

ACH.The Automated Clearing House is a computer-based clearing and settlement service for the interchange of electronic debits and credits among financial institutions.

The page refreshes and the Consumer ACH Outgoing Transactions filter criteria become available.

calendar icon and select the start and end dates for the days you want report on.

calendar icon and select the start and end dates for the days you want report on.Some date fields in this application offer calendars that allow you to select the date to enter in the date field. When a calendar is available, the calendar icon is present. Click the calendar icon to open the calendar. In the calendar, use the outer arrows to switch between years, and the inner arrows to switch between months. Click a date to insert the date into the date field.

_

_

Note: To select multiple bank numbers, press and hold Ctrl, and then click the bank numbers you want.

Merchant ID number.

Merchant ID number.A number assigned by TSYS that identifies the merchant.

Note: You can search for a merchant ID number. For more information, refer to Searching for data entities.

ACH Tran Code, select it from the drop-down list.

ACH Tran Code, select it from the drop-down list.The ACH transaction code. Possible values are as follows:

SEC Code, select it from the drop-down list.

SEC Code, select it from the drop-down list.The ACH network supports different payment applications, and each ACH application is identified and recognized by a specific Standard Entry Class (SEC) Code, which appears in the ACH record.

The SEC Code identifies the ACH transaction type relevant to the application; whether it is a consumer or commercial transaction. Each SEC Code has different Rule, Authorization, or disclosure requirements.

Note that:

This table lists the SEC Codes that TSYS processes:

SEC Code |

Title |

Transaction Type |

Transaction Code |

When to apply |

|---|---|---|---|---|

CCD |

Corporate Credit or Debit Entry |

Commercial |

Both Credits and Debits |

Business to Business (B2B) ACH transactions should use this SEC Code, when obtaining Authorization via a signed form (a/k/a Trading Partner Agreement), verbally over the phone, or via the internet |

PPD |

Prearranged Payment and Deposit Entry |

Consumer |

Both Credits and Debits |

The consumer signs a form authorizing withdrawal from their account |

POP |

Point of Purchase |

Both |

Debits Only |

Converted check at the point of purchase |

TEL |

Telephone-Initiated Entry |

Consumer |

Debits Only |

Consumer provides oral Authorization via the telephone |

WEB |

Internet-Initiated Entry |

Consumer |

Debits Only |

Consumer provides Authorization via the internet or a wireless network |

Note: This table only provides general information about each SEC Code, which is subject to change at any time. For complete up-to-date information on SEC Codes, refer to the latest NACHA Operating Rules and Guidelines.

If data for the selected criteria are available, the  Summary Report opens.

Summary Report opens.

Note: You can customize the data you want to view. For more information, refer to Customizing Reports.

When you run the report, it first opens as a  Summary Report. You can then select a Merchant Number to drill down to the Detail Report, listing the individual transactions for that merchant.

Summary Report. You can then select a Merchant Number to drill down to the Detail Report, listing the individual transactions for that merchant.

The report includes the following data:

Summary Report

Merchant Name

Merchant NameThe merchant's DBA (Doing Business As) name.

Merchant Number

Merchant NumberA number assigned by TSYS that identifies the merchant.

Phone/Entry Description

Phone/Entry DescriptionThe phone number or a description of the entry method for the transaction. This is field is populated when the NACHA (National Automated Clearing House Association) file is created.

Returns Count

Returns CountThe number of credit transactions (not consumer ACH returns).

Returns Amount

Returns AmountThe dollar amount of credit transactions (not consumer ACH returns).

Detail Report

Individual Ref ID

Individual Ref IDThe number by which the individual (or business) is known to the originator.

Tran Date

Tran DateThe date that the transaction occurred.

PreNote Flag

PreNote FlagThis indicates whether (Y) or not (N) the transaction is for pre-notification. This is used to determine the correct ACH Transaction Code.

Tran Code

Tran CodeThe code for the type of transaction or activity.

Account Type

Account TypeIndicates the account type associated with the transaction:

Disc Data/Payment Type

Disc Data/Payment TypeDepending on your system configuration, the column will contain either:

SEC Code is WEB (Internet-Initiated Entry) or TEL (Telephone-Initiated Entry):

SEC Code is WEB (Internet-Initiated Entry) or TEL (Telephone-Initiated Entry):The ACH network supports different payment applications, and each ACH application is identified and recognized by a specific Standard Entry Class (SEC) Code, which appears in the ACH record.

The SEC Code identifies the ACH transaction type relevant to the application; whether it is a consumer or commercial transaction. Each SEC Code has different Rule, Authorization, or disclosure requirements.

Note that:

This table lists the SEC Codes that TSYS processes:

SEC Code |

Title |

Transaction Type |

Transaction Code |

When to apply |

|---|---|---|---|---|

CCD |

Corporate Credit or Debit Entry |

Commercial |

Both Credits and Debits |

Business to Business (B2B) ACH transactions should use this SEC Code, when obtaining Authorization via a signed form (a/k/a Trading Partner Agreement), verbally over the phone, or via the internet |

PPD |

Prearranged Payment and Deposit Entry |

Consumer |

Both Credits and Debits |

The consumer signs a form authorizing withdrawal from their account |

POP |

Point of Purchase |

Both |

Debits Only |

Converted check at the point of purchase |

TEL |

Telephone-Initiated Entry |

Consumer |

Debits Only |

Consumer provides oral Authorization via the telephone |

WEB |

Internet-Initiated Entry |

Consumer |

Debits Only |

Consumer provides Authorization via the internet or a wireless network |

Note: This table only provides general information about each SEC Code, which is subject to change at any time. For complete up-to-date information on SEC Codes, refer to the latest NACHA Operating Rules and Guidelines.

SEC Code

SEC CodeThe ACH network supports different payment applications, and each ACH application is identified and recognized by a specific Standard Entry Class (SEC) Code, which appears in the ACH record.

The SEC Code identifies the ACH transaction type relevant to the application; whether it is a consumer or commercial transaction. Each SEC Code has different Rule, Authorization, or disclosure requirements.

Note that:

This table lists the SEC Codes that TSYS processes:

SEC Code |

Title |

Transaction Type |

Transaction Code |

When to apply |

|---|---|---|---|---|

CCD |

Corporate Credit or Debit Entry |

Commercial |

Both Credits and Debits |

Business to Business (B2B) ACH transactions should use this SEC Code, when obtaining Authorization via a signed form (a/k/a Trading Partner Agreement), verbally over the phone, or via the internet |

PPD |

Prearranged Payment and Deposit Entry |

Consumer |

Both Credits and Debits |

The consumer signs a form authorizing withdrawal from their account |

POP |

Point of Purchase |

Both |

Debits Only |

Converted check at the point of purchase |

TEL |

Telephone-Initiated Entry |

Consumer |

Debits Only |

Consumer provides oral Authorization via the telephone |

WEB |

Internet-Initiated Entry |

Consumer |

Debits Only |

Consumer provides Authorization via the internet or a wireless network |

Note: This table only provides general information about each SEC Code, which is subject to change at any time. For complete up-to-date information on SEC Codes, refer to the latest NACHA Operating Rules and Guidelines.