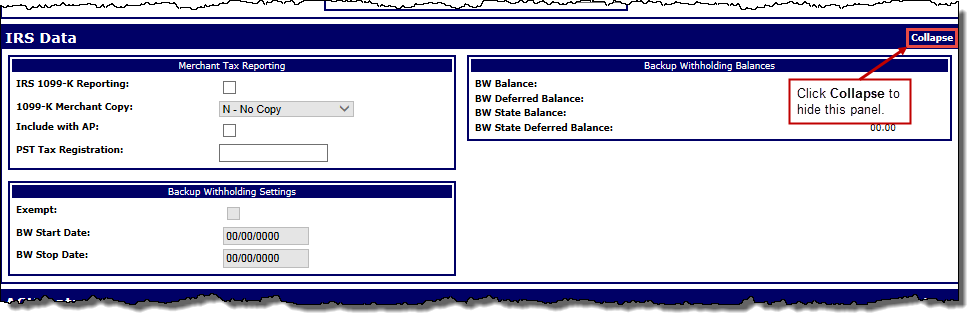

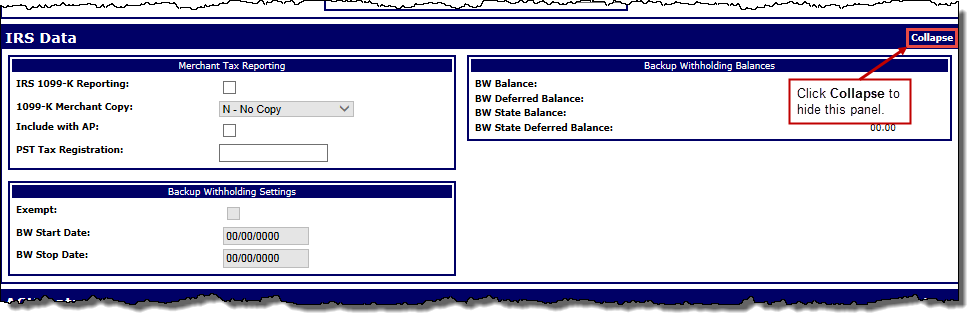

These fields concern participation in Merchant Tax Reporting (MTR) and IRS Backup Withholding (BW) compliance mandate (6050W):

Merchant Tax Reporting

- IRS 1099-K Reporting: If available, select this check box if the merchant is participating in Merchant Tax Reporting as part of the 6050W mandate.

- 1099-K Merchant Copy: If available, from the drop-down list, select the appropriate option to specify whether the merchant will receive either a paper or an electronic copy of the 1099-K form, neither, or both.

- Include with AP: If available, select this check box if the merchant should be rolled up into the Aggregated Payee level 1099-K volume. If enabled, the merchant will be rolled into either their Association or their Association's First-Level Group.

- PST Tax Registration: This field only appears if the merchant is associated with a Canadian bank, and should contain the merchant's 15-digit Canadian Provincial Sales Tax (PST) Registration number.

Backup Withholding Settings

Note: The following fields are only available if the Merchant's Bank is configured to participate in Backup Withholding and you have the sufficient user privileges.

- Exempt: Select this check box if the merchant is exempt from Backup Withholding.

- BW Start Date: The effective start date of backup withholding (if any), where the system has identified the Tax Identification Number (TIN) as missing.

- BW Stop Date: The effective stop date of backup withholding (if any), where the system has identified the TIN as valid.

Backup Withholding Balances

- BW Balance: The actual federal backup withholding balance obtained during ACH processing.

- BW Deferred Balance: The current backup withholding balance that has not been collected.

- BW State Balance: The actual state backup withholding balance obtained during ACH processing.

- BW State Deferred Balance: The current state backup withholding balance that has not been collected.