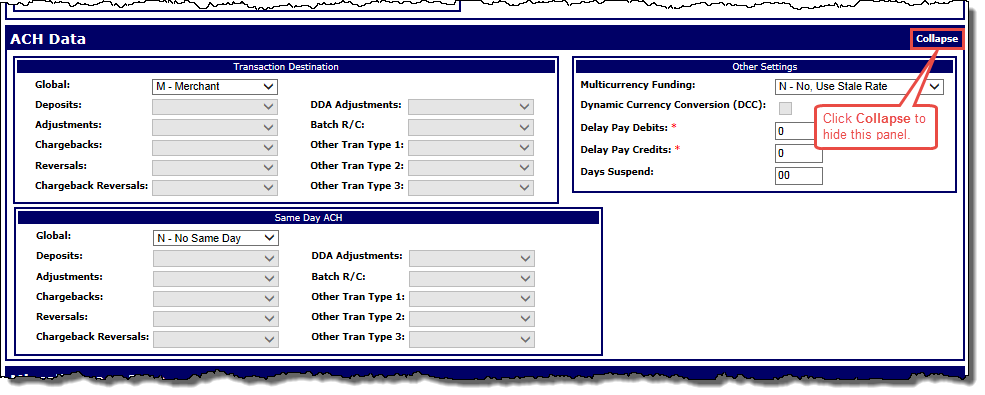

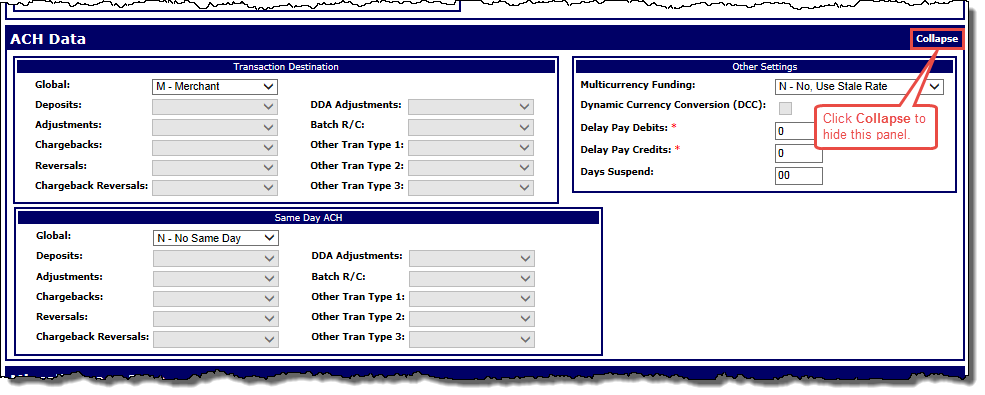

These fields govern the electronic transfer of funds, allowing the merchant's demand deposit accounts to be updated through magnetic tape or transmission, and enable you to configure transaction destinations and miscellaneous ACH settings (fields marked with a red asterisk are mandatory):

Note: You can configure ACH settings for full service merchants only; the following fields will be unavailable for front end only merchants.

Transaction Destination

- Global: If you want to set a single transaction destination for all transaction types, select one of the following options from this drop-down list (this will make the fields for the individual transaction types in this sub-panel unavailable):

- A - Association: Transactions post to the association’s DDA.

- M - Merchant: Transactions post to the merchant’s DDA.

- X - No ACH: Transactions do not receive ACH funding.

- G - Group: Transactions post to the group’s DDA.

- R - Rollup: Transactions roll up into one ACH entry and post to the merchant’s DDA.

- B - Assoc Roll: Transactions roll up into one ACH entry and post to the association’s DDA. The association profile must also have the Global field set to B - Assoc Roll.

- H - Group Roll: Transactions roll up into one ACH entry and post to the group’s DDA. The group profile must also have the Global field set to H - Group Roll.

Note: If you want to select the R - Rollup, B - Assoc Roll, or H - Group Roll option but find it is not available from the drop-down list, contact your TSYS relationship manager for more information about transaction destination values.

-or-

If you want to set transaction destinations for the transaction types individually, select the blank option from the Global drop-down list, and then select one of the above options for each of the following transaction type fields in this sub-panel:

- Deposits

- Adjustments

- Chargebacks

- Reversals

- Chargeback Reversals

- DDA Adjustments

- Batch R/C

- Other Tran Type 1

- Other Tran Type 2

- Other Tran Type 3

Same Day ACH

Note: The Same Day ACH sub-panel will only appear if your system has been configured to enable Same Day ACH processing.

- Global: If you want to set a single same day ACH setting for all transaction types, select one of the following options from this drop-down list (this will make the fields for the individual transaction types in this sub-panel unavailable):

- N - No Same Day: No same day ACH processing for transactions.

- C - Credits Only: Same day ACH processing for credit transactions only.

- D - Debits Only: Same day ACH processing for debit transactions only.

- B - Both: Same day ACH processing for both credit and debit entries.

-or-

If you want to set a same day ACH setting for the transaction types individually, select the blank option from the Global drop-down list, and then select one of the above options for each of the following transaction type fields in this sub-panel:

- Deposits

- Adjustments

- Chargebacks

- Reversals

- Chargeback Reversals

- DDA Adjustments

- Batch R/C

Other Settings

- Multicurrency Funding: If you want the merchant to participate in multicurrency funding, select one of the following options from to drop-down list to to define the timing (the processing day) of the currency rate to use to fund the merchant:

- N - No, Use Stale Rate

- A - Use Latest Available Rates

- G - Group

- R - Rollup

- Delay Pay Debits: Enter the number of days you want to delay ACH for the merchant's debit transactions. Currently, this should be set to 0.

- Delay Pay Credits: Enter the number of days that you want to delay ACH for this merchant's credit transactions. Currently, this should be set to 0.

- Days Suspend: If required, enter the number of days a merchant’s funds should be suspended before they are released at ACH.