Configure charge records

Charge records contain details related to service changes that can be applied to a merchant. Express allows you to configure charges for a number of merchant services.

Note: You can configure charge records for full-service merchants only. The information in this topic does not apply to front-end only merchants.

To configure charge records for a merchant:

- At the Merchant Card Plans page, click Next.

-or-

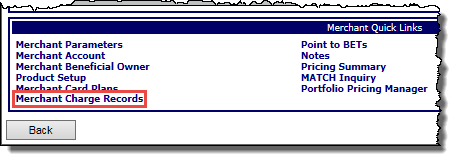

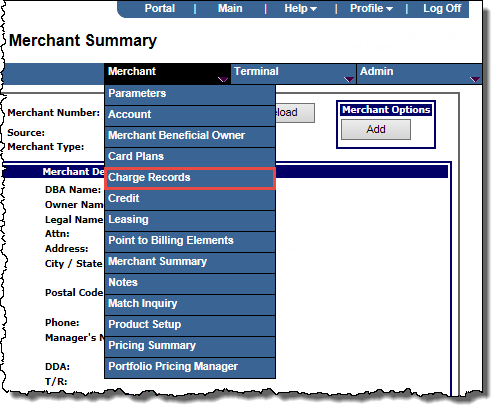

For an existing merchant record, search for the merchant to display its details on the Merchant Summary page, and then:

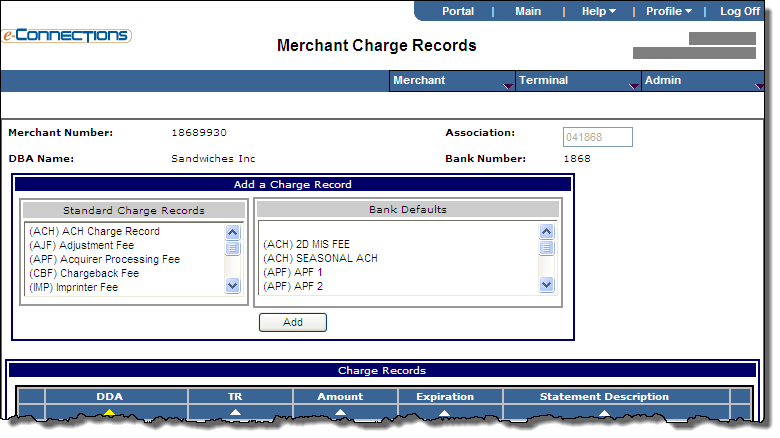

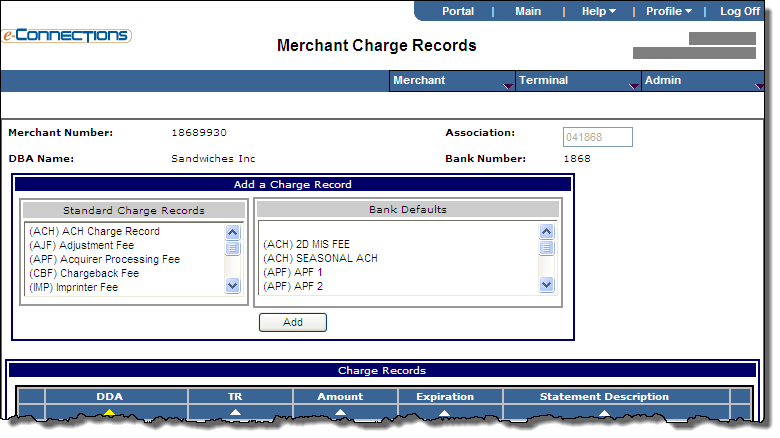

The Merchant Charge Records page for the merchant opens.

- If the merchant is already boarded, click Edit.

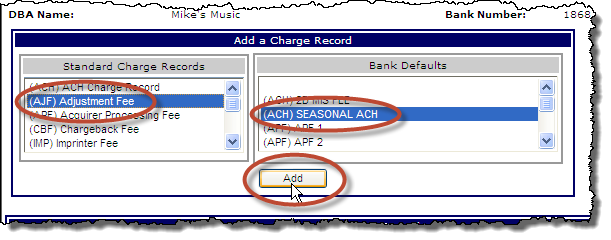

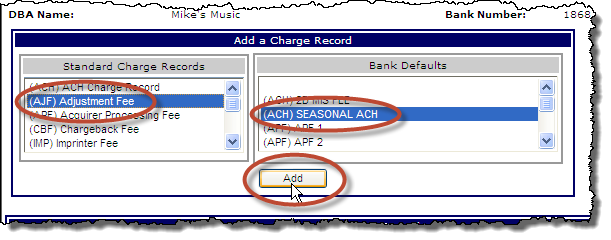

- To add a charge record for the merchant, in the Add a Charge Record panel, select one of the Standard Charge Records from the list, and if you want, one of the Bank Defaults from the list, and then click Add.

-or-

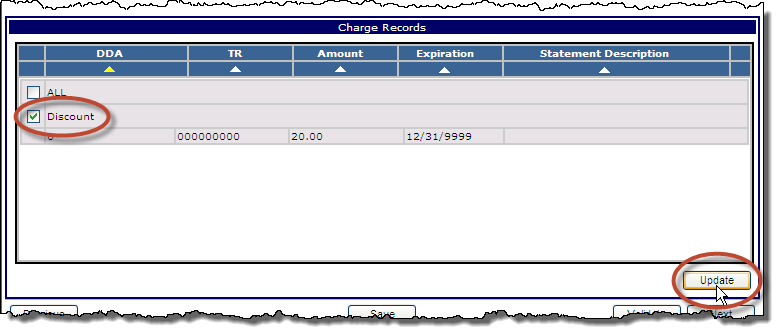

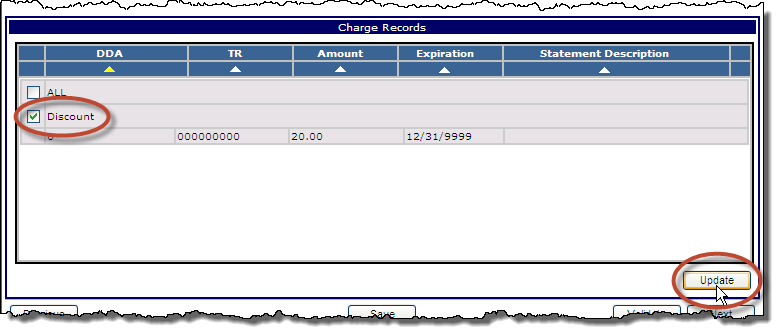

To edit an existing charge record for the merchant, in the Charge Records panel, select the check box for the charge record you want to edit, and then click Update.

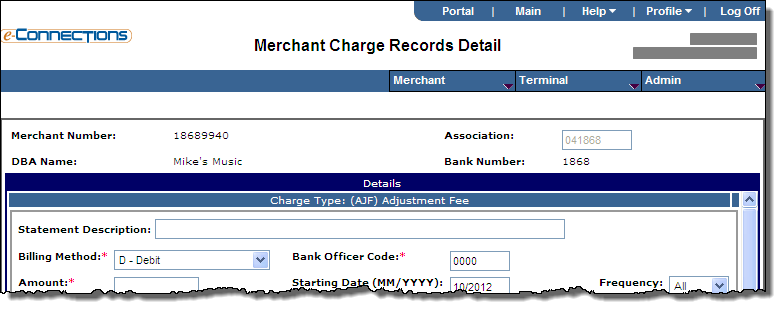

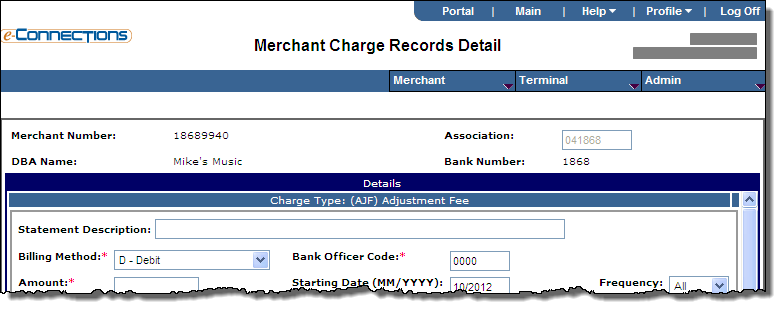

The Merchant Charge Records Detail page for the charge record opens.

- Add or edit the information for the charge record in the following fields; fields marked with a red asterisk are mandatory.

- Statement Description: Enter the message you want appearing on the merchant statement.

- Billing Method: From the drop-down list, select one of the following options to indicate the billing method for the merchant discount and fees:

- D - Debit: Indicates the merchant is debited the amount of the charge after receiving the statement.

- R - Remit: Indicates the merchant remits the charge after receiving the statement.

- Amount: Enter the client-defined amount for this charge record.

- DDA: Enter the Demand Deposit Account number for this charge record. This is a checking account used for transferring funds to and from a merchant for credit card processing deposits and fees.

- T/R: Enter the transit routing number used by the Federal Reserve to process transactions for this charge record.

- Bank Officer Code: Enter the client-defined numeric code for the officer that approved the account or DDA. This field is informational only.

- Starting Date (MM/YYYY): Enter the month and year in MM/YYYY format in which charges for this record begin. The default value for this field is the current month and year.

- Expiration Date: Enter the date in MM/DD/YYYY format on which charges for this record will expire, or click the calendar icon

and select the date from the pop-up calendar. A value of 12/31/9999 indicates that the charge record has no expiration date. As part of the bank default charge records process, the purpose of this field is to allow you to charge a fee monthly for a specified number of months, up to 1 year after the merchant is boarded. If you select Some from the Frequency field and just one month from the Month field below, this allows you to charge a fee once, but to set the expiration date out for up to 13 months, so that you can choose to re-assess the fee during that time period by selecting an additional month for this charge record at the merchant level without having to also change the expiration date.

and select the date from the pop-up calendar. A value of 12/31/9999 indicates that the charge record has no expiration date. As part of the bank default charge records process, the purpose of this field is to allow you to charge a fee monthly for a specified number of months, up to 1 year after the merchant is boarded. If you select Some from the Frequency field and just one month from the Month field below, this allows you to charge a fee once, but to set the expiration date out for up to 13 months, so that you can choose to re-assess the fee during that time period by selecting an additional month for this charge record at the merchant level without having to also change the expiration date. - Frequency: From the drop-down list, select one of the following options to indicate the frequency at which a merchant is billed for a charge:

- All: Select this option if the merchant is to be billed every month.

- Some: Select this option if the merchant is to be billed in specific months.

- Months: This field is only available if you have selected the Some option from the Frequency field above. Select each month in which the merchant is to be billed; use SHIFT+click and CTRL+click to make multiple selections.

- If you want too delete the charge record, click the Delete button.

- Click Save, and then Validate or Board as required.

- Click Next to open the Point to BETs Summary page, where you can configure Billing Element Tables (BETs) for the merchant.