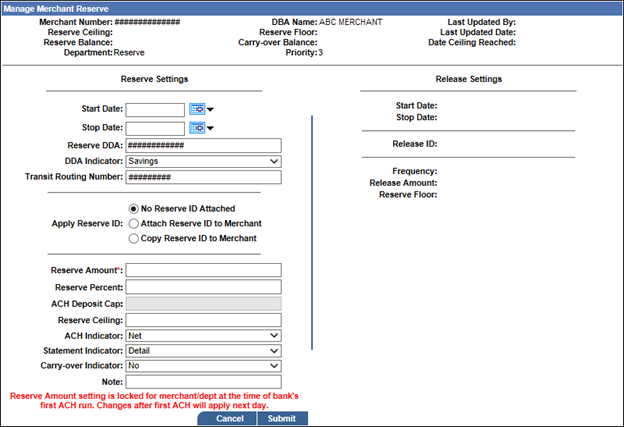

If you want to attach an existing Reserve ID to the merchants's Reserve Settings, from the Apply Reserve ID option buttons, select the Attach Reserve ID to Merchant button, click the  icon to open the Select Reserve ID list, select the required Reserve ID, and then click Load.

icon to open the Select Reserve ID list, select the required Reserve ID, and then click Load.Note: If you attach an existing Reserve ID to the merchant's Reserve Settings, the Reserve ID values cannot be changed at the Manage Merchant Reserve dialog box. These can only be changed at the Maintain Reserve ID dialog box. If you want to copy the values of an existing Reserve ID and modify them, select the Copy Reserve ID to Merchant button as described next.

-or-

If you want to copy an existing Reserve ID to the merchants's Reserve Settings, from the Apply Reserve ID option buttons, select the Copy Reserve ID to Merchant button, click the  icon to open the Select Reserve ID list, select the required Reserve ID, and then click Load.

icon to open the Select Reserve ID list, select the required Reserve ID, and then click Load.

Note: If you copy an existing Reserve ID to the merchant's Reserve Settings, you can modify the settings at the Manage Merchant Reserve dialog box without affecting the actual Reserve ID values, which can only be changed at the Maintain Reserve ID dialog box.

The Copy Reserve ID to Merchant option button is only available if the merchant currently has no existing Reserve ID attached.

-or-

If you do not want to apply an existing Reserve ID to the merchant's Reserve Settings but want to enter your own settings manually, from the Apply Reserve ID option buttons, select the No Reserve ID Attached button, and then enter the reserve details in the following fields:

Reserve Amount

Reserve AmountThe amount of funds to be withdrawn from the merchant's DDA account.

Note: The amount or percentage of funds you are able to release or reserve may be controlled by your system administrator.

Reserve Percent

Reserve PercentThe percentage of funds to be withdrawn from the merchant's DDA account.

Note: The amount or percentage of funds you are able to release or reserve may be controlled by your system administrator.

ACH Deposit Cap

ACH Deposit CapThe maximum deposit to fund to the merchant. Any amount over the deposit cap is placed into reserve.

Reserve Ceiling

Reserve CeilingThe maximum threshold amount specified for the reserve account. Once this maximum amount is reached, no more funds will be reserved. The value can be set either in a bank-level Reserve ID An ID, unique by Bank, to identify bank-level Reserve settings, that can be assigned to merchants. or as a merchant-level Reserve Setting.

ACH Indicator

ACH IndicatorThis value indicates how the reserve entries will be handled in the ACH file for the Merchant DDA. This is set as a Bank Default, but the value can be changed when adding or updating a Reserve ID or as a merchant-level Reserve Setting.

Select one of the following values from the drop-down list:

- Net: Indicates the Reserve Funding amount is subtracted from the merchant's Net Deposit, so the merchant will see one credit entry with the Net amount against their DDA.

- Separate: Indicates separate entries for the Reserve Funding are created for ACH processing, so the merchant will see two entries against their DDA: one credit entry for the Net Deposit, and one debit entry for the Reserve Funding amount.

Statement Indicator

Statement IndicatorThis value indicates if the Reserve Funding section will display on the merchant’s statement, and which version will display; summary or detail. This is set as a Bank Default, but the value can be changed when adding or updating a Reserve ID or as a merchant-level Reserve Setting.

Select one of the following values from the drop-down list:

- None: Indicates the Reserve Funding section will not appear on the merchant's statement.

- Detail: Indicates daily Reserve Funding activity will appear on the merchant's statement.

- Summary: Indicates a summary of the Reserve Funding activity for the month will appear on the merchant's statement.

Carry-over Indicator

Carry-over IndicatorThis value indicates whether carry over will be used when reserving funds. This is set as a Bank Default, but the value can be changed when adding or updating a Reserve ID or as a merchant-level Reserve Setting.

Select one of the following options from the drop-down list:

- Yes: Any reserve amount not able to be taken during ACH processing will be added to the Carry-Over Balance and will try to be satisfied in the next ACH run.

- No: Any reserve amount not able to be taken during ACH processing will be ignored.

Note

NoteThis field allows you to enter a note when creating or editing merchant reserve or release settings. The note is saved for audit reporting each time the settings are saved, allowing you to enter a new note each time you edit the settings.

The note entered appears on the Merchant Management screen, in the Activity: Last 10 Users Actions section. The note also appears on the Online Activity Report.

Rolling Reserve Indicator

Rolling Reserve IndicatorThis field appears on the Manage Merchant Reserve, Add New Reserve ID, and Maintain Reserve ID box if the Bank selected is setup for Rolling Reserve.

When set to Yes, funds are reserved for the merchant for a specified number of days.

When managing the settings on the Manage Merchant Reserve, Add New Reserve ID, or Maintain Reserve ID box, if you select Yes from this drop-down list, the box refreshes to include the Number Of Days field, where you can enter the number of days for the funds to be reserved.

Number of Days

Number of DaysIndicates the number of days funds are reserved for the merchant.

When managing the settings on the Manage Merchant Reserve, Add New Reserve ID, or Maintain Reserve ID box, if the Bank selected is setup for Rolling Reserve and you select Yes from the Rolling Reserve Indicator drop-down list, the box refreshes to include the Number Of Days field, where you can enter the number of days the funds are to be reserved.

Search for the merchant to open the Merchant Management frame for that merchant.

Search for the merchant to open the Merchant Management frame for that merchant.

![]() icon to open the Select Reserve ID list, select the required Reserve ID, and then click Load.

icon to open the Select Reserve ID list, select the required Reserve ID, and then click Load.